Talk to us

Have questions? Reach out to us directly.

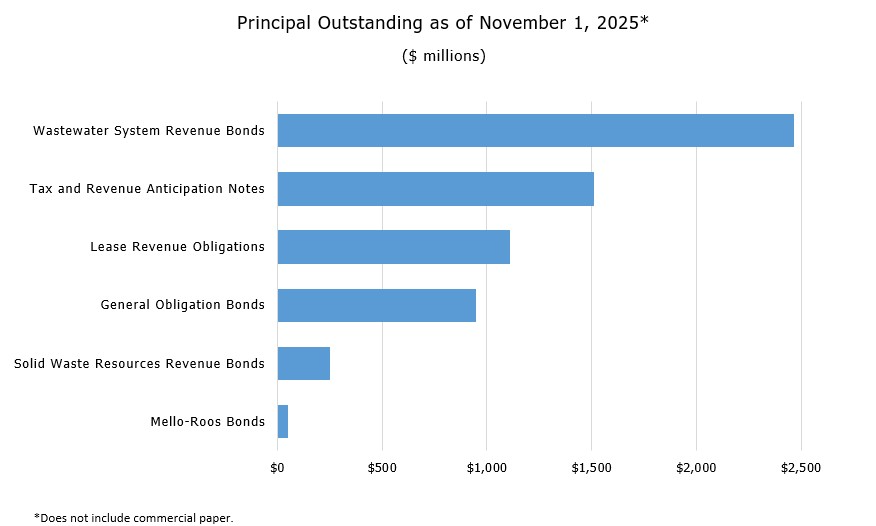

Debt Programs Managed by the City Administrative Officer (CAO)

Please see below for a summary of the debt programs managed by the CAO.

WASTEWATER SYSTEM REVENUE BONDS:

Los Angeles Wastewater (LAWW) System Revenue Bonds and Wastewater Commercial Paper Notes are used to finance capital improvements related to the City’s wastewater system (Wastewater System). The Wastewater System serves an approximately 600 square mile area with a population in excess of 4.5 million or approximately 45% of the population of Los Angeles County. The Wastewater System has two distinct services areas: the Hyperion service area and Terminal Island service area. In addition to serving most of the City, the System also provides wastewater conveyance, treatment, and disposal services to 29 entities, including sanitation districts, cities, governmental entities, and private businesses which adjoin the City. The Wastewater System consists of more than 6,800 miles of mainline sewers, four water reclamation plants, and various other facilities. As of November 1, 2025, there is $2.47 billion in outstanding LAWW System Revenue Bonds. In addition to long-term debt, the City has a Wastewater System Commercial Paper Notes Program of up to $400 million.

TAX AND REVENUE ANTICIPATION NOTES:

The City annually issues tax and revenue anticipation notes (“TRANs”) to alleviate short-term cash flow needs that occur early in the fiscal year when taxes and revenues have not yet been received. A large portion of these cash flow needs arise from the City’s long-standing practice of paying its contribution to its pension systems early in the fiscal year to receive a discount. As of November 1, 2025, there is $1.51 billion in outstanding TRANs.

GENERAL FUND LEASE FINANCINGS:

Since the creation of the Municipal Improvement Corporation of Los Angeles (MICLA), a nonprofit public benefit corporation, in 1984, the City has entered into lease financings with MICLA for certificates of participation, lease revenue bonds or similar financial instruments. As of November 1, 2025, there is $1.11 billion in long-term outstanding lease revenue obligations. In addition to long-term debt, the City has two MICLA Commercial Paper (CP) Programs totaling up to $525 million. Debt issuances under this program have been used for the acquisition and improvement of real property and capital equipment.

GENERAL OBLIGATION BONDS:

Between 1989 and 2016, City voters approved the issuance of General Obligation (GO) Bonds totaling over $3.7 billion for various City projects, such as for libraries, police, fire safety, seismic safety, zoo, animal shelters, emergency operations, storm water, and homeless housing. As of November 1, 2025, there is $950 million in outstanding GO Bonds. Further, there is $60.5 million of unused GO Bond authorization for storm water projects pursuant to Proposition O and $86.0 million of unused GO Bond authorization for homeless housing and facilities projects pursuant to Proposition HHH as of November 1, 2025. The voters may approve additional GO Bonds in the future.

SOLID WASTE RESOURCES REVENUE BONDS:

Solid Waste Resources (SWR) Revenue Bonds are issued to finance the acquisition and improvement of certain real property and capital equipment for the City’s solid waste collection and disposal system (Solid Waste System). The Solid Waste System provides solid waste collection services to approximately 743,000 households within six collection districts. The 743,000 households serviced by the Solid Waste System generally represent single family dwellings, duplexes and multi-family dwellings of four units or less. As of November 1, 2025, there is $253 million in outstanding SWR Revenue Bonds.

LAND-SECURED MELLO-ROOS SPECIAL TAX FINANCINGS:

The Land-Secured Mello-Roos Special Tax Financing Program predominantly encompasses Mello-Roos (or Community Facilities Districts (CFD)) financings. The City periodically receives requests to create CFDs or other special districts for various types of infrastructure improvements. Bonds payable from special taxes within the CFD would be issued to finance such improvements. As of November 1, 2025, the City has CFD special tax bonds outstanding for the following CFDs: City of Los Angeles Community Facilities District No. 4 (Playa Vista-Phase I), City of Los Angeles Community Facilities District No. 8 (Legends at Cascades), and City of Los Angeles Community Facilities District No. 11 (Ponte Vista). There is $52.1 million in outstanding CFD special tax bonds as of November 1, 2025. In 2013, the City formed Community Facilities District No. 9 for the Downtown Streetcar. The City has not issued bonds for the project.

Parking System Revenue BONDS:

The Parking System Revenue Bonds are paid from revenues collected from on-street and off-street meters and parking lots owned and operated by the Los Angeles Department of Transportation. In Fiscal Year 2013-14, the City redeemed all outstanding bonds totaling $80.9 million with lease revenue commercial paper notes. While there are no immediate plans to issue additional bonds, the City may do so in the future.

Judgment Obligation BONDS:

From time to time, the City has issued judgment obligation bonds to finance larger judgments or settlements, as it did in Fiscal Years 2008-09 and 2009-10. As of November 1, 2025, there are no judgment obligation bonds outstanding. The City may issue judgment obligation bonds in the future.

Special Tax or Assessment District Financings:

In the past, the City has issued special tax and assessment supported debt. The City currently does not have any bonds outstanding in its Special Tax or Assessment District Financing Program, it has previously issued MICLA Special Tax Lease Revenue Bonds (Police Emergency Command Control Communications System) and Landscaping and Lighting District 96-1 Assessment Bonds.

Other Types of Transactions:

From time to time, the City may engage in other types of financing transactions such as public private partnerships (P3) and Pension Obligation Bonds.

Debt Programs Not Managed by the CAO

Three departments that are under the control of Boards appointed by the Mayor and confirmed by the Council, namely the Los Angeles Department of Water and Power, Los Angeles World Airports, and the Port of Los Angeles, directly manage their own bond programs. Further, the Los Angeles Housing Department directly manages housing bonds for qualified developments located in the City of Los Angeles.

Talk to us

Have questions? Reach out to us directly.